501C3 Scholarships

501C3 Scholarships - Eine 501 (c) organization (kurz: A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. The name comes from section 501 (c) (3) of the. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. Nonprofit, charity, exempt organization, and 501 (c) (3). Unsure if your nonprofit qualifies for 501(c)(3) status? In reality, an organization could be one of those, all of those, or somewhere in. A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. What is a 501 (c) (3) nonprofit organization? Learn the requirements and costs of setting up a 501(c)(3). The name comes from section 501 (c) (3) of the. Many people use these terms interchangeably: 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. Unsure if your nonprofit qualifies for 501(c)(3) status? A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. What is a 501 (c) (3) nonprofit organization? Nonprofit, charity, exempt organization, and 501 (c) (3). A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. Eine 501 (c) organization (kurz: In reality, an organization could be one of those, all of those, or somewhere in. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. What is a 501 (c) (3) nonprofit organization? Nonprofit, charity, exempt organization, and 501 (c) (3). Unsure if your nonprofit qualifies for 501(c)(3) status? Many people use these terms interchangeably: In reality, an organization could be one of those, all of those, or somewhere in. Eine 501 (c) organization (kurz: A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. Learn the requirements and costs of setting up a 501(c)(3). Many people use these terms interchangeably: What is a 501 (c) (3) nonprofit organization? A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. The name comes from section 501 (c) (3) of the. Eine 501 (c) organization (kurz: Nonprofit, charity, exempt organization, and 501 (c) (3). A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. Unsure if your nonprofit qualifies for 501(c)(3) status? In reality, an organization could be one of those, all of those, or somewhere in. Nonprofit, charity, exempt organization, and 501 (c) (3). Many people use these terms interchangeably: Eine 501 (c) organization (kurz: What is a 501 (c) (3) nonprofit organization? The name comes from section 501 (c) (3) of the. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. Nonprofit, charity, exempt organization, and 501. The name comes from section 501 (c) (3) of the. Unsure if your nonprofit qualifies for 501(c)(3) status? Eine 501 (c) organization (kurz: What is a 501 (c) (3) nonprofit organization? A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of. Eine 501 (c) organization (kurz: A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. In reality, an organization could be one. Unsure if your nonprofit qualifies for 501(c)(3) status? Eine 501 (c) organization (kurz: Many people use these terms interchangeably: What is a 501 (c) (3) nonprofit organization? 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. Learn the requirements and costs of setting up a 501(c)(3). What is a 501 (c) (3) nonprofit organization? A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section. Nonprofit, charity, exempt organization, and 501 (c) (3). A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. Many people use these terms interchangeably: The name comes from section 501 (c) (3) of the. Learn the requirements and costs of setting up a 501(c)(3). Nonprofit, charity, exempt organization, and 501 (c) (3). In reality, an organization could be one of those, all of those, or somewhere in. Eine 501 (c) organization (kurz: Many people use these terms interchangeably: A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. What is a 501 (c) (3) nonprofit organization? Unsure if your nonprofit qualifies for 501(c)(3) status? A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good.Miss Vermont’s Teen Awards First Scholarship from her 501c3 Defying

501c3 scholarship financialaid community stlouis Philip McRae

Choosing a NonProfit vs an LLC in Biotech Research

Scholarships The St. Louis American Foundation

Scholarships The St. Louis American Foundation

fellowship scholarship payingitforward bayarfellowship ivyleague

Ajilla The Ajilla Foundation Scholarship is Now Open! At the Ajilla

We reached 501c3 status and support low carbon and energy Society for

York Energy Solutions Foundation Inc 501c3 on LinkedIn The YES

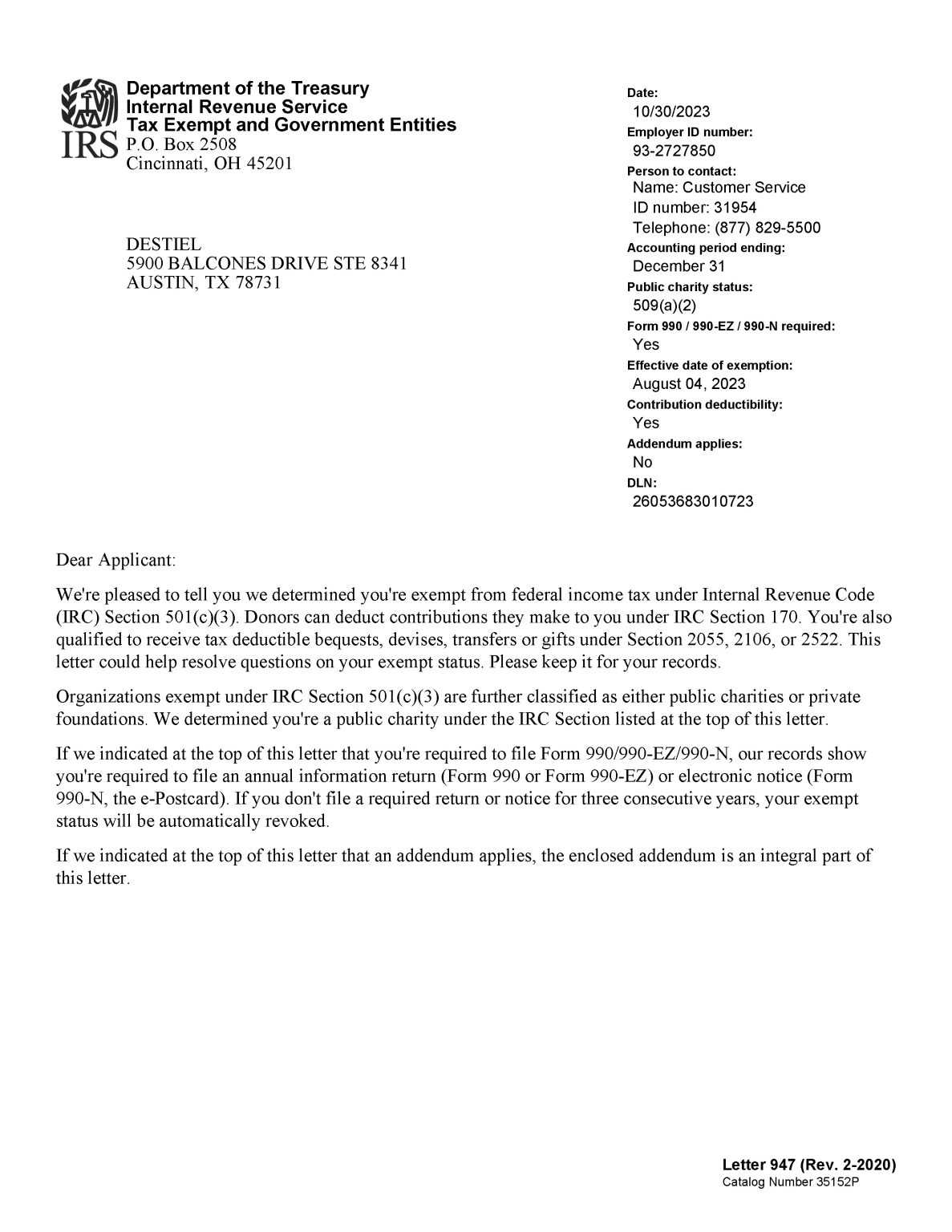

501(c)(3) IRS Determination Letter Destiel

The Name Comes From Section 501 (C) (3) Of The.

501 (C)) Ist Eine Gemeinnützige Organisation, Nach Dem Bundesrecht Der Vereinigten Staaten In Übereinstimmung Mit Dem Internal Revenue Code (26.

Learn The Requirements And Costs Of Setting Up A 501(C)(3).

Related Post: